The Verdict from over 300 CEOs: Europe Can Match the US in Scaling £100 million Companies Within 10 Years - If We Get the Ingredients for Success Right

- Amy Wilson-Wyles

- Oct 4, 2024

- 7 min read

In the rapidly evolving world of technology, particularly as AI emerges as a transformative force, it is critical for European companies to not only keep pace but to lead in the next decade.

At Boardwave Live, our biggest event to date, we revealed the findings from our survey of over 300 European tech leaders. The survey provides deep insights into how our members are navigating this landscape, alongside a snapshot of the industry as a whole, and reveals both the opportunities and challenges ahead.

Despite concerns, the results are encouraging, showing that the European software sector has significant potential. This report will examine the key findings, shedding light on the trajectory of growth, the shifting priorities of companies, and how Boardwave is committed to supporting its members through our new Boardwave Accelerate Programme.

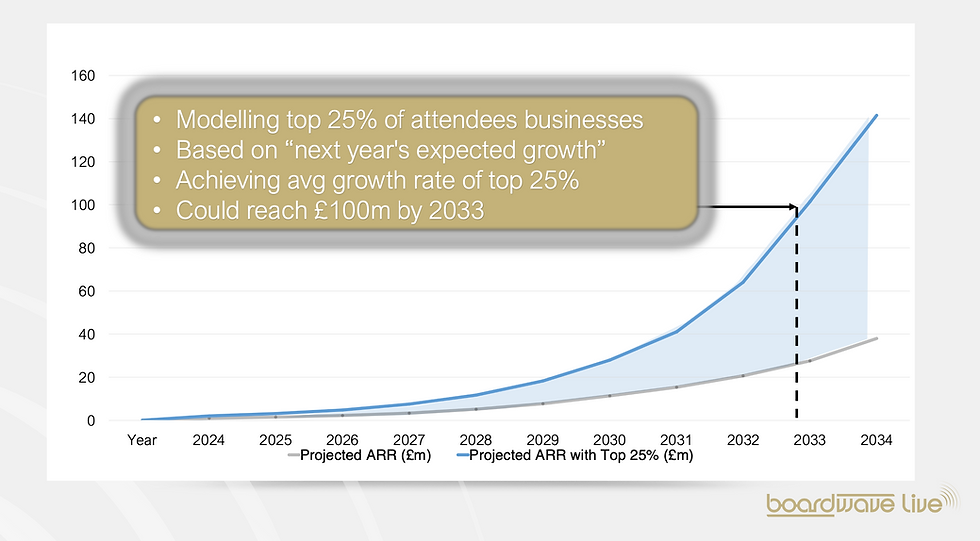

Scaling to £100m: A Quarter Are on Track, But the Clock Is Ticking

While the survey reveals that over 25% of companies are showing a growth trajectory that if maintained would enable them to reach £100 million by 2033, this should be seen as an opportunity rather than a limitation. As Phill Robinson, our CEO, said: “A quarter of companies hitting this significant milestone is a great start, but it’s also a call to action. We should be aiming higher.” With the right support, strategies, and tools in place, there is room to grow this figure incrementally, even a few percentage points would make a massive difference. Boardwave is focused on exactly this through its new Boardwave Accelerate Programme (more on this later), which aims to provide companies with the resources and community support to not only stay on track but surpass their growth targets.

The 25% figure speaks to both the success stories and the barriers companies face. Scale-ups, in particular, are at a critical juncture. Unlike start-ups that often benefit from robust funding and support systems, scale-ups face a unique set of vulnerabilities. Phill noted, “Start-ups are actually as well-funded in Europe as in the U.S. The real vulnerability lies in the scaling phase, where companies struggle to maintain growth momentum.” This survey serves as a wake-up call - our work is just beginning, but the path to success is clearer than ever.

From Job Market Jitters to AI Ambitions: How Priorities Have Flipped

The concerns of companies have dramatically shifted over the last two years. In 2022, in a volatile job market, organisational design and hiring topped the list, today AI is the dominant focus.

This shift reflects the massive disruption AI is beginning to bring to industries worldwide. Interestingly, companies in the just starting (£0-1 million category) do not raise it as a concern at all. This is partly expected, since new companies are presumably “baking it in” to their products from the start. But in all other growth categories, it’s a concern, as it means re-evaluating engineering priorities and retrofitting AI into legacy products that will need to be reworked or even completely rebuilt. In fact, the higher up the growth stage, the higher it was as a concern. Companies are now asking, "Where are we in the AI development timeline?"

According to the Boardwave survey and Phill’s remarks, we are merely at the beginning stage of AI's evolution - nascent but full of potential. "AI is still in its early stages. We’re at the dial-up phase, and while there’s a lot of hype, the real breakthroughs are yet to come,” explained Phill to the audience at the IET. “But that also means the opportunity is wide open for those who move now. While those that don’t risk becoming vulnerable to being disrupted by a competitor.”

The European technology sector cannot afford to fall behind, as it did in the internet era. Now is the time to make bold moves, innovate, and position ourselves as leaders in AI.

Painkillers, Not Vitamins: Why Mission-Driven Companies Lead the Pack

One of the most compelling findings from the survey is the link between being mission-driven and achieving sustained growth. The data suggests that companies with a clear mission are significantly more likely to scale and reach the £100 million mark. As Phill succinctly put it, “If you’re not mission-driven, you will not get there. It’s as simple as that.”

Moreover, mission-driven companies need to focus on creating “painkillers, not vitamins” - products that are essential to solving widespread problems, not just local or ‘nice-to-have’ solutions. “The companies that will succeed are the ones solving bigger, universal challenges, not just localised problems. This is the key to building a global business, you can’t just solve a problem unique to one country, as that won’t allow you to scale.” said Phill. This focus on broader impact not only attracts customers but also investors who are seeking companies with a clear and powerful mission.

Successful companies in our network, such as Aforza and Board Intelligence, exemplify this mission-driven approach. They are creating essential solutions that drive growth and have the potential to dominate their industries.

The Blueprint for Scaling: What Every Leader Needs to Know

In panels throughout the day at Boardwave Live, along with the survey, the key conditions for scaling at pace were also explored and examined. These conditions include:

Strategic Clarity: Companies need to have a growth mindset and constantly evaluate their product-market fit and ensure their strategy is aligned with market needs.

Sales Efficiency: Scaling sales operations in a repeatable and effective manner is critical to driving growth and building durable and resilient companies.

Governance and Leadership: Strong board governance and mission-driven leadership development are essential to navigating the complexities of scaling.

Talent Acquisition: Companies need access to a deep talent pool and must focus on developing a robust internal culture that attracts and retains top talent.

Founder Resilience: Our founders have historically had a reputation of being more risk averse than US founders. It’s partly because it takes 15 years to scale here vs 10 years (so a Catch 22) but it’s a factor that you have to be in it for the long-game.

Focus on solving a "big" problem: Not one tied to a small local market. A great example of this is Typeform, which defied all of the usual growth statistics we usually see in Europe to reach $100 million in 10 years, thanks to a global product.

Access to capital: The start-up phase in Europe is well funded, but that gets more tricky as companies scale. Partly because a VC that has £1 to spend will spend it on a company growing faster than slower, so is predisposed to invest in US businesses vs European ones. Hence the need to scale quicker, so that we attract more investment from VCs that would have historically invested elsewhere.

Unlocking Growth: How Boardwave's Accelerate Programme Helps You Succeed

At Boardwave, we recognise the immense potential of our members and are dedicated to helping them achieve their growth goals. Our new Accelerate Programme is designed to provide tailored support to CEOs and founders at different stages of their growth journey. This programme will offer:

Curated Breakouts: Having successfully seen over 150 CEOs and founders through our first wave of Breakouts, we will now be offering all members the chance to join a Breakout group. Comprising cohorts of 8-10 CEOs and founders, matched together based on growth-stage, geography and concern, these groups will come together four times a year to collaborate closely, share insights, and support each other in overcoming obstacles, thereby creating a micro community around every member and their needs. We will also match a Boardwave Patron (or a Nextwaver for those in the £1-10 million range) that is suited to each group - these are internationally recognised leaders with outstanding track records of success. As the programme progresses, if your group is working through a problem that they are finding hard to resolve, we can bring in a Boardwave expert, either into the next meeting or for a zoom call, to help create clarity and progress.

Growth Stage-Specific Events: Events that focus on the specific challenges faced at each growth stage, from early scale-ups to established companies.

Platform Connectivity: Our new platform will facilitate easy connections between members, allowing them to share best practices, tools, and advice as part of a growing 1,700-strong network.

McKinsey Partnership: A Powerful Diagnostic Tool

A key addition to our Accelerate Programme is the strategic partnership with McKinsey. This partnership brings a powerful new diagnostic tool to the table for companies with a £10-50 million ARR, and is designed to help identify the specific areas where members can accelerate business growth. McKinsey will conduct a comprehensive assessment of your business, looking at leadership, growth strategies, and operational efficiency.

As Phill Robinson explained, "McKinsey has developed a diagnostic that dives deep into your company’s performance, offering you a detailed report on where you can improve and how you can grow faster. The great thing is that most of their fees are deferred until you see real results."

This partnership ensures that Boardwave members not only receive valuable insights but also have the support to implement the strategies that will drive them forward - helping more companies join the 25% on track to hit £100m in revenue within the decade. Look out for more updates on this partnership in the coming weeks.

Conclusion: A Time to Lead

The results of this survey suggest that the European software industry may be on the cusp of something great. But we cannot afford to be complacent. The lessons of the past are clear: now is the time to act boldly, leverage AI, and build mission-driven companies that will lead in the global market. As Phill stated, “This is our moment. We have the chance to learn from past mistakes and build something bigger, better, and more meaningful.”

With Boardwave’s Accelerate Programme, we are committed to helping our members turn this potential into reality, ensuring that more than just 25% of companies reach their £100 million targets by 2034. Together, we can shape the future of the European software industry - driving innovation, encouraging faster growth, and creating a lasting impact on society.

Comments